Dental practices are facing significant financial pressure. A recent DrBicuspid.com survey revealed that 65% of dentists rank rising operational costs as their top concern.1 At the same time, the ADA’s Health Policy Institute reports that overhead expenses are climbing faster than inflation—up 3% annually—while revenue per dentist continues to decline.2 This widening gap between costs and income is eroding profit margins and threatening long-term sustainability.

The Solution? Strategic Fee Adjustments.

Without annual increases, practices risk falling behind, making it harder to cover rising wages, technology investments, and everyday expenses. A well-planned fee increase protects profitability and positions your practice for success in 2026.

Don’t Believe the Managed Care Myth

“I’m contracted with several PPO plans, so a fee increase won’t help,” is one of the most frequent objections we hear. Here’s the truth: healthy fees matter, even if you participate in PPO plans. They influence your negotiation leverage and future reimbursements. Ignoring annual fee adjustments will only worsen the gap between rising costs and stagnant income.

Benefits of Healthy Fees

- Negotiation Power: Higher fees strengthen your position with managed care companies.

- Dual Coverage: 60% of households have dual income, increasing opportunities to bill full office fees.

- Annual Increases: Regular adjustments improve your area fee profile.

- Private Pay Patients: On average, 15–20% of patients pay out-of-pocket.

- Out-of-Network Billing: Balance billing opportunities exist.

- Practice Transitions: Healthy fees make your practice more attractive to buyers.

- Overhead Control: Higher fees reduce overhead percentage relative to collections.

Fee Trends

The Practice Support Team (PST) tracks trends in data collected from practices throughout the year. In 2025, fees remained flat at the 57th percentile, and only 7% of practices reached the 80th percentile or higher. Many fee schedules were unbalanced, with codes below the 40th percentile or above the 95th.

2026 Recommended Fee Increase

Based on trends and expert guidance, a 4% annual increase remains appropriate for 2026, consistent with McGill Advisory and Cain Watters recommendations. A higher increase will be necessary for practices that have fallen behind. This accounts for:

- Rising staff wages due to labor shortages

- Increased technology and equipment costs

- The need to maintain profitability despite stagnant PPO reimbursements

The Math Behind the Impact

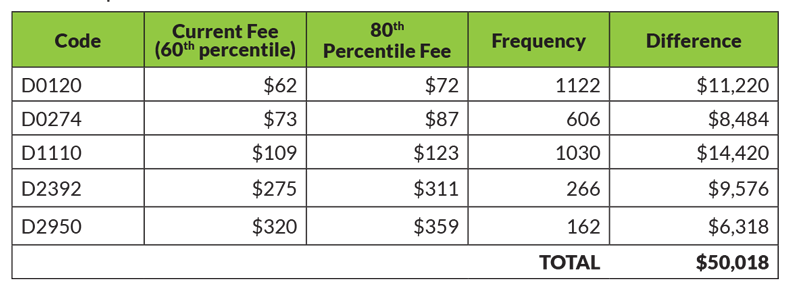

With 30 codes accounting for 90% of production, optimizing fees is critical. Moving from the 60th to the 80th percentile can generate thousands in additional revenue annually with minimal patient impact (see example below).

Act Now

Practices that fail to act will suffer financially through higher overhead and lower profits.

PST is ready to help you with a zip code-specific Fee Analysis to ensure your fees are balanced and competitive—complimentary for Supply Savings Guarantee clients and those spending an average of 40K annually on merchandise with Burkhart. Just $99 for non-qualifying practices, which includes code-by-code recommendations.

Reach out to your Burkhart Account Manager or Burkhart’s Practice Support Team with your questions regarding changes in codes, coding strategies to maximize reimbursement, and analyzing managed care participation in your practice.

Your success is our success. Please reach out to us anytime.

Learn more, visit the Practice Support Team page, email us at PracticeSupportTeam@BurkhartDental.com, or call 1.800.665.5323.

Published in Catalyst – Q1 2026.

Category: Practice Consulting

Back to Articles